Katrina - Five Years After  [Fri, August 27, 2010] Five years ago, Hurricane Katrina devastated the Gulf region, killing nearly 2,000 and forcing

more than 250,000 others out from their destroyed, damaged or flooded homes. For many Americans, August 29th marks an anniversary

that has scarred both bodies and souls. It was one of the worst and costliest natural disasters in U.S. history that left

thousands of families homeless and displaced. [Fri, August 27, 2010] Five years ago, Hurricane Katrina devastated the Gulf region, killing nearly 2,000 and forcing

more than 250,000 others out from their destroyed, damaged or flooded homes. For many Americans, August 29th marks an anniversary

that has scarred both bodies and souls. It was one of the worst and costliest natural disasters in U.S. history that left

thousands of families homeless and displaced.

This week, Hurricane Katrina

is on the front pages of most newspapers, blogs and television programs. All looking back at the physical and emotional

wreckage, the lives it impacted, the lessons learned and the questions that are yet to be answered. Some of the questions that stil hunt Katrina victims are regarding property insurance, cancelled

policies, underpaid or denied claims, increased insurance costs and high deductibles. Insurance companies have played

a major role in the rebuilding of the Gulf region, yet home and business owners are still struggling to rebuild and pay for

the damage. Below is a selection of well written recent articles that address

insurance matters of Hurricane Katrina. Hurricane preparedness and insurance coverage information

is essential for every property owner! For your free insurance claim consultation please contact me or call my office at 954.742.8248. Hope for the best, prepare for the worst.

Fri, August 27, 2010 | link

American Integrity Insurance Company is First to Launch

Vacant Home Insurance Policy in Florida  According to Business Wire, American Integrity marked a first among Florida-based insurance companies by launching an insurance policy to cover vacant homes. According to Business Wire, American Integrity marked a first among Florida-based insurance companies by launching an insurance policy to cover vacant homes.

American Integrity's Dwelling Policy (DP-1) provides a solution for this need by providing

a no-frills policy to insure for catastrophic or large loss events. Features

of American Integrity's DP-1 include coverage for a home or condominium and can be occupied by the owner or another party.

This product is particularly well-suited for seasonal residents who live in Florida part-time. American Integrity reports

its call volume has significantly increased with requests for this type of product which underscores that the need is growing,

and customers are seeking affordable home insurance alternatives. Homeowners’

policies are meant to insure homes that are occupied, so they generally include exclusions for neglect or property abandonment

on a home left vacant or unoccupied for a specified number of consecutive days, often 30 days. Because vacant and unoccupied

homes pose a higher risk for damage than occupied homes, insurance companies insure these properties differently and usually

at a higher price.

Fri, August 20, 2010 | link

Required Reading For All Property Owners & Policy

Holders  I’ve come across a terrific letter written by David Beasley, President of

the Florida Association of Public Insurance Adjusters published by the Times-Union/Jacksonville.com a few days ago. I’ve come across a terrific letter written by David Beasley, President of

the Florida Association of Public Insurance Adjusters published by the Times-Union/Jacksonville.com a few days ago.

The letter is in part a respond to an article regarding the work of Public Adjusters, and in part serves as an excellent source of information

that should be required reading for all property owners and policy holders. I applaud Mr. Beasley for speaking out on behalf of all the licensed and professional

Public Adjusters, those making a significant difference in the lives of property owners. Professional Public Adjusters are experienced dealing with the preparation, negotiation, and settlement

of claims arising out of insured property losses. Handling and submitting any claim to an insurance carrier, including knowledge

of what the policy covers and, most importantly, what is contained in the small print is essential. The insurance company adjuster's job is to adjust a claim using his/her company's guidelines.

That adjuster decides the coverage, scope, and ultimately the value of the insurance claim. By leaving that discretion to

the company's adjuster, the policy holder is doing their family, and their business a great disservice. As per the recent OPPAGA report, findings show that compared claims filed between March

2008 and June 2009 found that policyholders generally received larger insurance settlements when represented by a public adjuster.

“The typical payment to a policyholder represented by a public adjuster was $22,266 for claims filed in 2008 and 2009

related to the 2004 hurricanes. In contrast, policyholders who did not use a public adjuster received typical payments of

$18,659.” Insurance companies are in business to make

a profit, and more often then not their settlements to the insured are minimal, leaving the insured in emotional and financial

distress. Public Adjusters represent the policy holders and exclusively evaluate, interpret, press, negotiate and certify

that the insurance settlement towards damages is just. Please click here to read the full article. I welcome your comments, questions or suggestions.

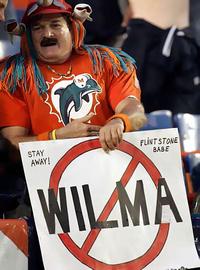

You have until October 2010 to file all claims related

to Hurricane Wilma

Almost 4.5 years after Hurricane

Wilma battered South Florida, some homeowners are still dealing with insurance claims. Some say insurance companies delay

payments and slow investigations. Many homeowners still struggle financially to cover all costs denied by their insurance

company.

Reasons for the unsettled or underpaid claims vary. After all, insurance companies

are like any other businesses, they are in it to make money, thus delaying payment to you or minimizing the settlement.

Unfortunately many homeowners learn years later how extensive hurricane damage was and that their insurance settlement only

covered a fraction of the damage. Many policy holders don't know their rights, and go along with an initial settlement offered

by the insurance company. - Do you have Hurricane

Wilma insurance claim that settled for less than you deserved?

- Do you have property damage claim from Hurricane Wilma that was denied by your insurance company?

- Didn't know that you can reopen a claim to cover

all your expenses?

- Still struggling to

pay the bill for repairs, business interruption or moving costs?

Call Today to get a just and fair settlement to cover all costs associated with Wilma: 954.742.8248 or contact me immediately. You have until October 2010 to file all claims related to Hurricane Wilma! A recent research study by the Office of Program Policy Analysis and Government Accountability showed that hurricane claims handled by Public Adjusters settled for over 700% more funds than those handled by the policy

holder! A licensed Public Adjuster will: - File (or re-file) your Hurricane Wilma insurance claim.

- Expertly assess, document and analyse all Wilma

related damage.

- Review all costs and losses associated with the claim,

such as business interruption, loss of income, moving or renting expense and repair costs following Hurricane Wilma.

- Professionally communicate and negotiate with your insurance company - we

speak the same language as your insurance company, but work for you!

- Handle

all related paper work, follow-up calls and appointments.

- Make sure

your insurance company is fully accountable for all damages and losses covered by the policy you continuously pay for.

Let a professional Public Adjuster review your Hurricane Wilma claim.

Florida law provides a five-year Statute of Limitations within which to file or re-open your

insurance claim. Thus, the deadline is fast approaching on the Hurricane Wilma insurance claims, so immediate action is required.

|